No, growth in IT Services can't make up for the declining Manufacturing growth.

Maybe AI together with solar power can do the trick.

Spoiler: As shown in a previos post, the declining Manufacturing Industries’ growth has been part of the explanation behind lower GDP per capita growth. Also, the lower weight of Manufacturing in the economy contributes to this. This post looks into industries whose weights in the economy are increasing, Information & Communication services. The growth rate in this service industry is higher than the Manufacturing growth rate.

However, its contribution to total GDP per hours worked also depends on its size. And even if its share has increased, it is not big enough to change the development of declining growth in the Swedish economy.

In my previos post, How Sweden chose lower growth”

I showed that:

The relatively stronger demand for services leads to a reallocation of capital and labour towards these industries from goods-producing industries.

The shift leads to a change in the industrial structure which reduces overall GDP per capita growth through two channels. Firstly, increasing shares of services in overall consumption, increases the weight of services industries relative to manufacturing industries. Secondly, services industries’ productivity growth is lower than manufacturing industries’ productivity growth. Thus, the contribution of the less productive services industries, to GDP per capita growth, increase at the expense of the more productive manufacturing industries.

Since then, new data has arrived allowing for analyses until 2022. Unfortunately, major revisions and changes in the presentation of individual industries complicated thing for me. Because of that the time series below begin in 1993 instead of 1980. In any case, the conclusions are the same as in the quotation above. The highest growth rate in GDP per hour is found in the declining manufacturing industries.

Shares in GDP , growth of GDP per hours worked and industry contributions to total GDP per hour growth 1993-2000, and 2000-2022.

Note: Shares in GDP are in percent and sum to 100. Growth of GDP per hour are in percent. Contribution to total growth of GDP per hour are in percentage points and sum to total growth of GDP per hour.

Market Services Industries displays the second highest growth rate. It is of course an aggregate which masks considerable differences. Some decline and some grow. Information & Communication Servcies not only grow faster after the turn of the Millennium but also increase its weight of Market Services, and the economy. The same goes for high-knowledge industries as Engineering and R&D services and Other professional activites. An industry which appears to include service activities not elsewhere classified.

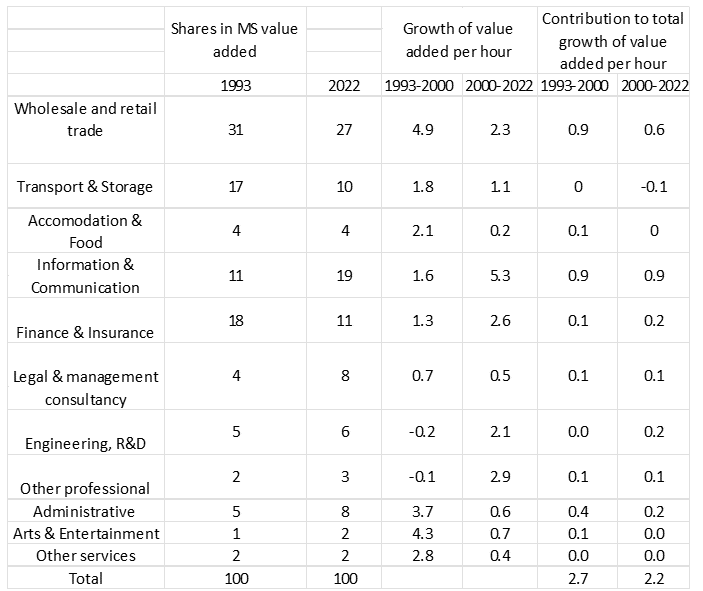

Shares in Market Services value added, growth of value added per hours worked and industry contributions to total Market Services per hour growth 1993-2000, and 2000-2022.

Note: Shares in value added are in percent and sum to 100. Growth of value added per hour are in percent. Contribution to total growth of value added per hour are in percentage points and sum to total growth of value added per hour.

Value added per hour worked in Information & Communication Services has grown faster than in Manufacturing industries since 2012.

Value added per hours worked in Manufacturing, Market Services, and Information & Communication Services 1993-2002. Index, 1993 = 1.0.

Source: Statistics Sweden.

The faster growth in Information & Communication Services has been achieved at both increasing shares of GDP and total hours worked (and employment). Those shares doubled and increased by a third respectively between 1993 and 2022. Also its share of total investments has increased, althoug with only five percentage points from 28 to 33 percent between 1993 and 2022. Using the average shares of invesment in value added 1993-2000, and 2000-2022 together with the growth rates of value added, yields marginal efficiency of capital (MEC) rates of 0.27 and 0.21 for those periods respectively. Baring in mind the usual grains of salt when calculating stuff involving capital stocks and investment, the MEC in Information & Communication Services exceed those in Manufacturing and Market Services.

The end of growth?

The increased growtn in this or other market services is not enough to compensate for the declining growth wehave witnessed since at least the Millennium. It has not been so far and it won’t be in the future. We still need more and better educated people

to counteract the declining growth from a shrinking manufacturing industry.

AI.

Lots of people think that AI will be the new panacea and lead to two-digit growth rates. I doubt it. Productivity growth is basically about ideas. Ideas that either makes it possible to produce new stuff with the same amount of inputs as before or make the same amount of stuff with a lower amount of inputs. Before new stuff can be made, resources must be allocated to implement the ideas, that is R&D. R&D does not come about by itself, the processes need resources, i.e. capital and labour of different kinds and qualities. Even if AI can significantly increase the number of ideas, the R&D still needs resources to transform those ideas into products. And ideas have been harder to come by as shown here.

But AI will increase productivity growth and make R&D easier. It can substitute chips for people. But new also AI in chips require more energy, capital, and labour. More resources. This means that if AI should make a difference, we need cheap energy.

Some people are more optimistic while others seem to be less optimistic like me. Here is a debate between two from each camp.

Solar power.

Cheap energy is on the horizon. Or even closer. Here is a screen dump from Casey Handmere’s blog. In the post from which I made the screen dump, he shows how cheap and big solar energy has become. And then he goes on to to list industrial applications of cheap energy, together with a prescription for their transition to solar as a fundamental source of energy, and estimates of their economic value.

Here comes the Sun!

Source: Casey Handmere’s blog.