Will the recession be a soft landing?

That depends a lot on Construction industry developements.

Spoiler: The Swedish economy has been expected to enter a recession for some time now. A year ago, many predicted that it would be a large slump. Thankfully, that has not yet happened. Our economy has been more resilient than expected. GDP refuses to decline. In the first quarter of 2023, it increased by 0.6% compared to the previous quarter and by 0.8 compared to the first quarter 2022. The labour market is, as I write this, stronger than ever.

But things can still go wrong. The construction industry may collapse in the near future. The industry has been booming for a number of years, benefitting from low interest rates and increasing incomes. The boom fuelled construction costs that have increased very fast and reached record levels. New dwellings are very expensive and many apartments remain unsold. On the demand side, expectations of a coming recession and higher interest rates push down housing prices. As predicted by Tobin, this leads to decrasing housing investments.

The decline in construction will spread to the rest of the economy. The size of the transmission depends on the interrlationships with the rest of the economy, and the construction industry’s share in total GDP and total employment.

In its June report on the Swedish economy, the National Institute of Economic Research, predicts that the coming recession will be mild with limited effects on the labour markets.

The Swedish economy will operate below capacity both this year and next. Sweden’s rate-sensitive households have been hit hard by high inflation and higher interest rates, as has residential constructions, which is now falling fast.

Together with a slowdown in exports, this means that GDP will decrease slightly in the coming quarters. Demand for labour is still strong, however, and there are no signs yet of the labour market deteriorating. The downturn in the economy is expected to be short-lived and mainly takes the form of lower productivity than normal in the business sector. It will have only a limited impact on the labour market, and unemployment will rise much less than in previous downturns.

The recent decision by the Riksbank to increase the interest rate increase from 3.5% to 3.75% will probably cool down the economic activity further. The NIER did expect the Riksbank to incrase its policy rate when they made their forecasts quoted above. The increases of the policy rate has contributed not only to falling inflation but also to expectations of a future lower inflation rate. Thus, the real interest rate has increased which should have a cooling effect on interest senstive consumption and investments.

Labour markets are nevertheless still strong and all indicators have moved in the right direction for some time now. The labour force participation rate is higher now than it’s been for at least 40 years and the employment rate has reached levels it had before our home-made financial crisis in the beginning of the 1990s. The unemployment rate has decreased by two percentage points compared to two years ago.

Labour force participation, employment, and unemployment (right axis) rates 2010:1 - 2023:4.

Source: Statistics Sweden, https://www.statistikdatabasen.scb.se/pxweb/sv/ssd/

Looking ahead until October 2024, NIER predicts that the labour force participation will increase slightly, that the employment rate will decrease by 0.5 percentage points and that unemployment rate will increase from 7.3% to 8.2% only.

The slump in the Construction industry

In the report mentioned above, NIER emphasises the fast falling residential construction. Dwelling starts fell by 50% and 56% respectively during the first quarter of 2023 compared to first quarter of 2022. And it’s getting worse. Permits for multi-dwelling and one or two-dwelling buildings fell by 67% and 50% respectively in 2023:1 compared to 2022:1.

Building permits and dwelling starts. New constructed buildings 2010:1 - 2023:1

Source: Statistics Sweden, https://www.statistikdatabasen.scb.se/pxweb/en/ssd/

For households, falling housing prices and increasing construction costs have led to significantly less transactions on the markets for both existing and newly constructed dwellings. On markets for existing houses, households that were considering to sell their apartments or houses hesitate to sell and look for new houses. They can choose to buy an old existing or a newly built dwelling. For households interested in buying a newly built dwelling, falling prices of existing dwellings and high construction costs of new dwellings force households to take larger mortgages to buy a new dwelling. Furthermore, increased interest rates leads to higher housing costs than before. Increased interest rates also affect those households that both sell and buy existing dwellings. Thus, the demand for loans has decreased.

For construction firms, higher interest rates mean lower returns of investment unless they can charge higher rents. But this is obviously not possible in the current situation. Most construction projects are therefore postponed or abondoned.

The table and graph below shows developments of prices and construction costs.

Prices of apartments and single houses in Swedish regions. June 2023 compared to 1, 6, and 12 months earliers.

Source: SBAB. sbab.se

Construction costs index 2015:1-2023:1. Index, 2015 = 100.

Source: Statistics Sweden, https://www.statistikdatabasen.scb.se/pxweb/en/ssd/

I would have preferred to show prices and construction costs per m2, but these are not readily available. In any case, the indicators imply an increasing negative gap between prices and costs reducing the profitability of housing investments.

Housing investments 1993:1 - 2023:1. Billions of SEK, 2022 fixed prices.

Source: NIER. https://www.konj.se/english/publications/swedish-economy-report/swedish-economy/2023-06-26-swedish-economy-report.html

Construction and the rest of the economy

The effect on the rest of the economydepends on the size of the construction industry in terms of production and employment and the strength of its relationship with other industries. Construction is not only construction of houses. It is also construcion of infrastructure, industry buildings and more. The available statistics do not permit to make a clear distincion between the different construction industries for employment and production. However, housing investments is clearly distinguishable and make up around 45% of total construction investments. Employment in pure housing construction appears to make up around 26% of all employment according to the available statistics. According to these, civil construction employment (infrastructure) account for 7%, and specialised construction employment for the lion share of 67%. We’ll bear this in mind when discussing the construction industry’s importance for the rest of the economy below.

In total, the Construction industry’s share in GDP and employment are around, 6% and 7% respectively. Its weight has increased over the years which I discussed in this post two years ago.

The stagnating Construction industry slows down Swedish growth

Spoiler: The historically meagre productivity growth of the Swedish Construction industry is a serious problem. Low productivity growth for an industry does not have to be a problem if the industry is small relative to the rest of the economy. But it is problematic when a large industry’s share in the economy is increasing over time at the same time as …

An industry’s relationship with the rest of the economy can be analysed with Input-Output analysis and be presented in terms of output multipliers and employment multipliers.

An output multiplier of 2 means that a fall in demand of one million SEK for construction goods will reduce total demand for goods in the economy by two million SEK. This report by the Construction Industries provides output and employment multipliers for the construction industry. A reduced demand of construction goods will lead to a fall of aggregate demand by a factor of 1.6 - 1.75, and decreased employment in the construction industry will decrase emploment in the total economy by a factor of 1.5. That gives us an indicator of the importance of the sector for the rest of the economy.

The coming months will show how large the effects will be. The fall in activity is about to show up also in unemployment as notifications of redundancies in the Construction industry are increasing.

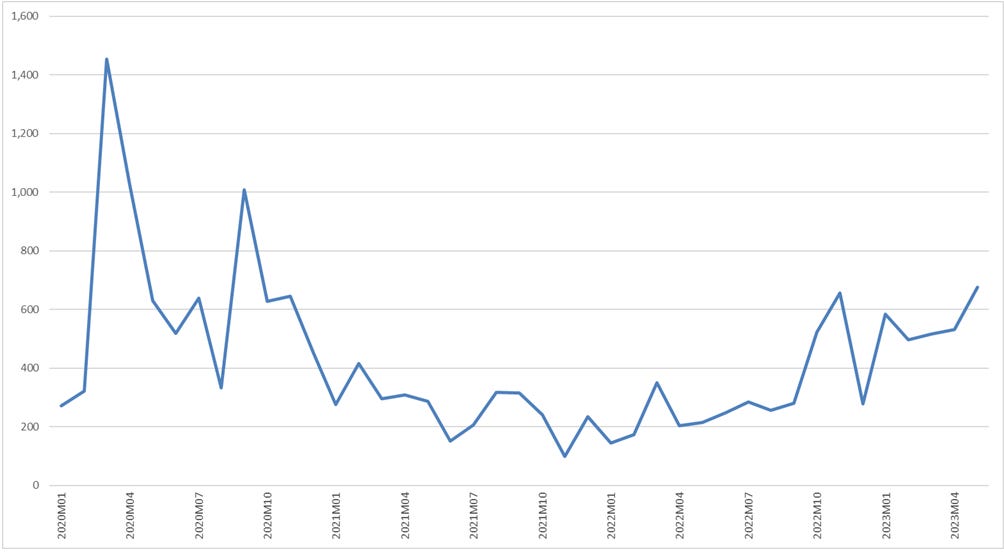

Monthly notifications of redundancies in the Construction industry 2020:1 - 2023:5.

Source: Swedish Public Employment Service, https://arbetsformedlingen.se/statistik/