US current account deficts are made by republicans.

US current account deficits have historiclly been generated by budget deficits. The deficits are larger when the president is a republican.

Spoiler: In the previous post I showed that a country’s current account balance is the result of the decions made to consume, save, and invest. I did not differentiate between private savings and public savings. In this post I will go a little bit deeper and show that even though private savings are high, public sector dissavings, (budget deficits) may lead to current account deficits if the deficits are absolutely larger than the private sector savings. Budget deficits mean that government expenditures exceed government revenues (mostly taxes).

Negative public financial savings in excess of positive private financial savings lead to current account deficits. The US’ twin deficits have been larger during republican presidents.

As I began to draft this post, a post from Tatyana Deryugina landed in my inbox. It is about the same subject and in it was a link to her previous post which was very similar to my previous post.

Anyway. To see how the current account depends on savings and investments, one should begin with income. A country’s total income, Gross national disposable income (GDNI) consists of income generated domestically and abroad. The income generated domestically is of course GDP. To that we can add the net flows of factor incomes which are wages and interest payments to labour and capital respectively. Also, the net flow of transfers from abroad should be countred. Flows that enter this category are EU-flows, development aid and more. These net flows are denoted F below.

This states that a country’s financial savings equals its incomes minus its expenditures which of course is equal to the current account. If a country’s incomes exceed its expenditures this shows up as an excess in the current account. The incomes from that can be used to buy assets abroad or borrow to foreigners.

To show how the government can affect the current account, some new elements need to be added to the above equation. The country’s financial savings is divided into private financial savings and public financial savings. Investments above are now divided into private investments and publis investments, I = I^P + I^G.

Private financial savings equals disposable income, Y^d minus consumption and investments, I^P. Disposable income equals income, Y, plus transfers, T^r (such as pensions) minus taxes, T.

Public financial savings equals government revenues, T, minus government consumption expenditures, G, transfers, T^r, and public investments, I^G. The difference between government revenues and its outlays for consumption, transfers and investments, make up the budget balance.

Adding taxes, transfers, and splitting investments in two parts yield the following identity.

Isolating the current account oth the right hand side shows how it is made up by the difference between private financial and public financial savings.

When governments run deficit, the second term on the left hand side is negative. Unless, that is more than compensated by the private sector’s private savings, the country has a current account deficit. Negative public financial savings have generated US current account deficits since the beginning of the 1980’s.

US current account and budget deficit in percent of GDP 1960-2024.

Source: Fred Database

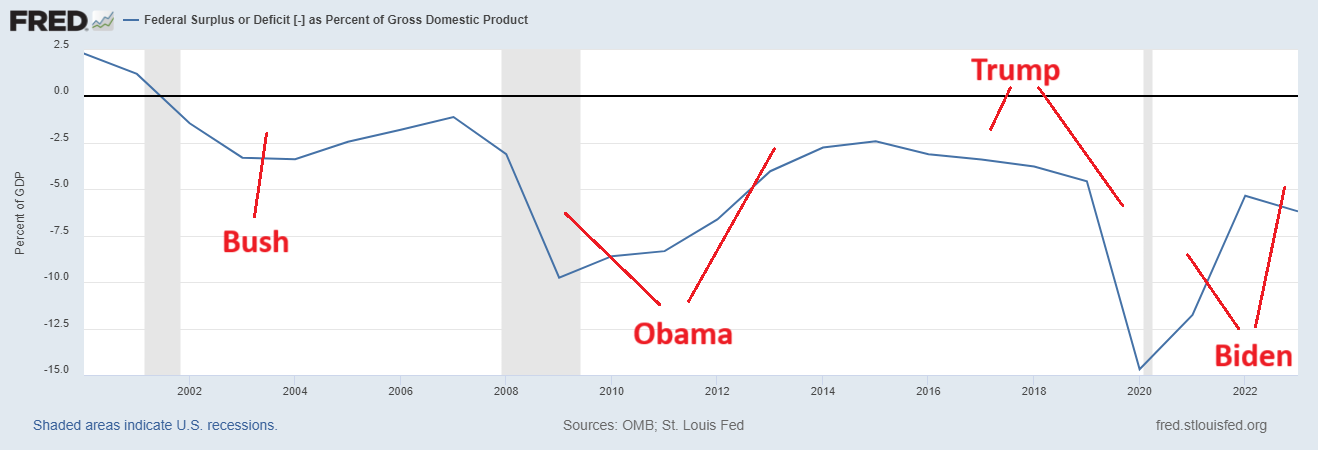

Historically, US budget deficits have been larger during republican presidents. And Trump is no exception to that rule. During Trump 1.0, the deficit increased by 2.5 percentage units before the Covid crisis hit USA. It improved during Biden.

US budget deficits since 2000. Percent in GDP.

Source: Noahpinion using data from Fred Database.

Trump has promised to lower taxes for the Americans even though he’s begun by raising taxes (tariffs). To lower taxes without increasing the budget deficit, he needs to cut expenditures. That’s why he hired the idiot Musk who has done nothing but creaing chaos with his DOGE.

My guess is that Trump will fail again, as he always does. Instead, the US national debt will continue to increase. I’ll get back to that in a post later on.

US national debt in percent of GDP

Source: Fred Database.