Update: A few hours after I had published this post, Moody’s lowered its expectations of the USA’s ability to service its debt:

Moody's Ratings (Moody's) has downgraded the Government of United States of America's (US) long-term issuer and senior unsecured ratings to Aa1 from Aaa and changed the outlook to stable from negative.

Moody’s worried about the US governments’ inabililities to reduce the debt since they have not been able to reverse the trend of fiscal deficits and growing interest costs. This year’s budget proposal by the Trump administration did not ease Moody’s concerns. Quite the opposite:

We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration. Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat. In turn, persistent, large fiscal deficits will drive the government's debt and interest burden higher. The US' fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns.

Spoiler: In the previous post about the US current account deficit, I focused on the part showing that negative public financial savings caused most of the US current account deficits. Negative public financial savings are budget deficits. Running public deficits when the growth of the economy exceeds the real interest rate may not increase the public debt. However, sustained slow growth at a lower rate than the real interest rate can cause countries’ public debts to grow very fast.

Trump’s policies will likely increase the US federal debt relative to GDP. The budget deficit will increase because since tariff revenues are too small, tax cuts too large, and cuts on expenditures too small to decreaser the deficit. This is no big problem as long as the growth of the economy exceeds the real interest rate on government loans. Should that change into the reverse, the debt will begin to grow very fast.

The debt and its change over time.

It might be a good idea to begin by showing how large the debt is. Sometimes one sees in the media that it is some 120% relative to GDP. However, that is Gross Federal Debt. This measure includes intragovernmental holdings such as social security funds and is some 20 percentage units higher. Excluding the government’s claims on itself, the debt relative to GDP is just below 100%.

US Federal Debt in percent of GDP.

Source: Fred Database. Note: Sometimes the measure

Now, let’s look at how debt changes. The increase in the debt from this year to the next yera evolves as

where D is debt, G, government revenues, T, taxes, and rD interest outlays on the current level of debt. G - T is the budget deficit if positive. However, stating the debt in absolute numbers does not make much sense. It is more reasonable to relate it to GDP, as in the graph above, since increased growth means that the country’s income increases and reduces its need to borrow. The change in the debt ratio, d = D/Y, from t to t+1 evolves as

where G - T is the budget deficit (expenditures minus revenues), Y is GDP, r is the real interest rate and g is the growth rate of GDP. The debt ratio increases when the budget shows a deficit, (G > T), and/or the real interest rate exceeds the economy’s growth rate, (r > g).

The above also shows that the debt can remain constant even if the government runs a budget deficit if the economy growth rate is larger than the real interest rate.

Will Trump increase the debt?

Maybe. It depends on how the budget budget balance changes once it has passed Congress. In case it will be a deficit again, the debt may increase unless the economy growth rate in excess of the real interest rate compensates for the increase. Beginning with the budget, the balance is the difference between revenues and expenses, T - G.

Tariffs won’t help.

Trump is trying to increase the revenues, T, by taxing US customers who wants to buy imported goods. But this will probably not work because he has raised tariffs by so much that trade is beginning to suffer. Demand for imports is decreasing so much that the tariff revenues will be very small. If one wants large revenues from tariffs, tariffs should be imposed on goods for which demand is not sensitive to price changes, inelastic goods. But I have not seen any sign indicating that the Trump administration is implementing tariffs in that way.

Anyway, tariffs only accounted for 1.6% of total federal revenues in 2024. Average tariff revenues in percent of total revenues 1962-2024 amount to 1.4%.

Tariff revenues in percent of total federal revenues in USA 1962-2024.

Source: Congressional Budget Office

Cutting expenditures and lowering taxes won’t help either.

So, Trump’s statements about tariffs bringing lots of revenues are merely nonsense. And it is crystal clear that tariffs can’t be used to finance any tax reductions he wants to implement since tariff revenues are very small compared to for example corporate income taxes. Corporate income taxes only account for 10% of total revenues.

Revenues by major source as percent in total revenues 2024.

Source: Congressional Budget Office

So, Trump needs to cut government outlays significantly. But he can’t cut anything he wants with an ordinary budget bill because some outlays are mandatory and require law changes to be cut or reduced while other are discretionary and can be cut in the budget. So, how much of the outlays are mandatory and how much are discretionary? Almost 27% of the outlays are discretionary. However, Trump is not going after everything that is discretionary because that includes military expenditures. Instead, he wants to increase those. Without mandatory and defence expenditures, he can cut outlays that represent 14% of total outlays in his first budget.

How large shares of total outlays can Trump cut this year?

Source: Congressional Budget Office.

Therefore, Trump has introduced a bill to both change the law and cut outlays. The effects of the bill if it passes as it stands now has been analysed by Center for American Progress. The bill will impose the largest cuts to Medicaid and food stamps in history. Combined with large tax cuts, favouring high-income brackets, the bill would add trillions of dollars to structural deficits. This conclusion is backed by the economist at the University of Pennsylvania. They conclude that the bill would increase the primary deficits (excluding interest outlays for the debt), and reduce economic growth.

So, Trump will increase the debt by increasing the deficits. Will he also make r > g?

How much and how fast the debt ratio increases depends on how Trump’s policies will affect GDP growth, especially in relation to the real interest rate as the equations above show.

A lot of people, including Paul Krugman and Bobby Kogan, worrr about that, especially since a high real interest rate has a negative effect on GDP growh. So, r-g > 0 increases debt by being positive and by pushing g down and thereby increasing the difference and its impact on the development of debt relative to GDP.

Yeah, so that's actually the other thing. It's not just that they're putting the non-interest, primary deficits in a worse position. They're all like Trump at the same time. Debt stability comes from primary deficits. It comes from the level of debt. It comes from your growth, your G, and it comes from your interest rate, R. And the Trump policy is lowering G and increasing R star, right? He's increasing R. And that is a really bad place to be in.

Kogan and Krugman are not the only who are worried about r > g. Noah Smith is panicking:

But interest rates are the proximate reason that the debt is becoming a problem right now, as the chart at the top of this post shows. As the government rolls over more and more of its bonds, they’re being forced to refinance at higher rates, and interest costs are soaring as a percent of GDP. Those costs are set to blow past the record set in the early 1990s.

That’s bad enough. But the bigger problem is that the GOP is preparing huge tax cuts that will make the problem even worse — and DOGE is doing nothing to help curb spending. The Democrats became fiscally irresponsible, but instead of responding by becoming the party of austerity, the GOP got even more spendthrift. As a result, the U.S. economy is headed for trouble.

He is not mentioning how Trump will affect GDP growth. But others are. Here’s Tatyana Deryugina’s concerns

But the most important question isn’t how much debt we have. It’s whether we can afford to service it. Right now, the US can still borrow at relatively low interest rates and has never defaulted on its debt. Plus, the US issues debt in its own currency—the dollar—which gives it more flexibility than countries that borrow in foreign currencies. But interest rates have been going up, which means that an increasing share of the US government budget will have to be devoted to making interest payments. That means less room for other priorities.

Rising debt also comes with other downsides: if interest rates rise, government debt can lead to lower private investment, which is sensitive to interest rates. High government debt can also reduce our ability to respond to future crises because investors aren’t as keen to lend to a country in trouble if its debt is already high.

In fact, many economists believe that Trump’s policies will cause a recession. In any case, GDP growth will be lower. Here’s the Yale Budget Lab’s scenario taking the latest Trump nonsense into account.

All 2025 US tariffs plus foreign retaliation lower real GDP growth by -0.7pp over calendar year 2025 (Q4-Q4). The unemployment rate ends 2025 0.35 percentage point higher, and payroll employment is 456,000 lower that same quarter. The level of real GDP remains persistently -0.36% smaller in the long run, the equivalent of $110 billion 2024$ annually, while exports are -15.5% lower.

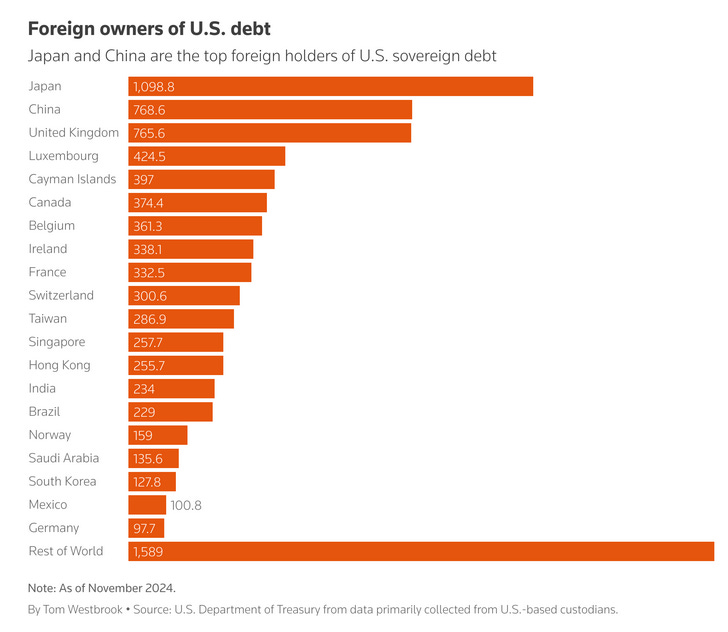

Tariffs push down the previously expected GDP growth of 1.8%, to below 1% for 2026 and 2027. After Trump, growth stabilises around 1.4% unless nothing is done to clean up Trump’s mess. But the above does not take the possibility of increasing interest rates into account. We have also seen that Japanese investors sold parts of their US debt which caused interest rates to increase and the dollar to weaken as the Japanese took their money elsewhere.

I doubt that foreign investors will dump their bonds and leave the US market in a rush because that would hurt themselves. Unless Trump comes up with something incredibly stupid that will scare foreign investors away. I think part of the interest rate on US bonds now consists of an insanity premium. Going ahead with the ideas about foreign debt in the “Mar-A-Lago-Accord” would do just that and maybe force US to go default.

In any case, the US federal debt will increase and will increase very fast unless someone manages to talk some sense into Trump. If not, the USA might enter into a stagflation.

.