Spoiler: It looks like it is JD Vance who has been given the task of rambling about trade deficits. Some people argue if JD is stupidly or spinelessly repeating Trump’s nonsense. He is both. You have to be to be part of the worst government in USA’s history.

The White House should be declared as an intellectual disaster area. Even though this post is a reaction to Vance’s stupidity, Pete Hegseth seems to be the dumbest of them all and quite possibly even manage to be sacked due to incompetence by the most incompetent president in the history of USA.

The Trump administration consists of people repeating his obsessions about USA being ripped off by countries whose people have engaged in mutually beneficial exchanges with people in other countries including USA.

Zombie analysis.

Source: Facebook.

Trump’s obsession with the US trade deficit only concerns trade with goods. Maybe because he knows that US runs trade surpluses in trade with services with most countries and the EU. Here’s the US balance of trade for services since 1992.

US services industries are ripping other countries off!

Source: Fred Database.

Anyway. Trump’s and Vance’s obsession with the trade deficit is wrong and stupid. Above, Vance claims that Americans are poorer becacuse of trade implying that bringing back jeans production from Lesotho would provide Americans with high wage jobs.

“Globalisation” has nothing to do with current account deficits.

Current account deficits occur either when thouseholds, firms, and public authorities in a country spend more on consumption and/or investments than they save. This can easily be shown with the GDP identity above.

Where Y is GDP, C, G, I, and NX, denote private consumption, government expenditures, investments, and net exports, exports of goods and services minus imports of goods and services. NX is the current account. Since this is an identity, it has nothing to do with “globalization”. Vance does not know that means but he knows that Trump and the MAGA-cult does not like it.

We can move around the terms a bit to show that the current account is the difference between the value of production and the value of consumption and investments, Y - C - G - I

I am not quite finished with the left hand side yet. The difference between GDP and private and public consumption expenditures amounts to a country’s total savings: Y - C - G = S.

This shows what I wrote above. A current account deficit occurs when savings are smaller than investments. This can occur because the people in a country consumes a lot, invests a lot or both. For example, assume that the people in a random country suddenly acquires a taste for couches. They decide to spend more on couches. Given that the total income, Y, has not changed, C and G increases which makes Y - C - G = S smaller. Since more of the country’s income is consumed, less is saved. If savings has decreased so much that it is smaller than investments it will be negative. And so will NX, the current account since it is an identity.

Current acounts can also occur if firms and governments in the country decides to invest more. Let us assume that firms in the random country thinks that it will be profitable to sell couches in the future. Therefore they decide to build new factories with new machines so their investments increase. At given levels of income and consumption expenditures, the increased investments will make S - I negative and therefore also cause a negative current account, NX.

In both cases, investments exceed savings. To finance the invesments, or consumption, the residents in the random couch-loving country borrows from or sell assets to residents in other countries.

The US current account deficits has not made Americans poorer.

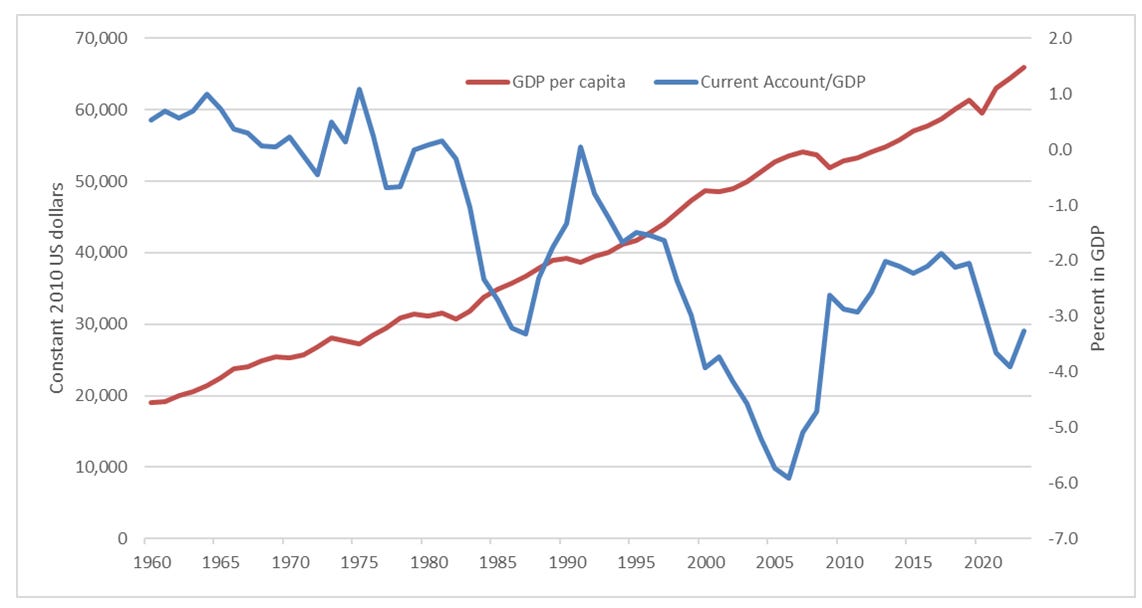

And Vance is talking nonsense about deficits and prosperity. USA has run a current account deficit since the beginning of the 1980’s. If one is to believe Vance, this has been devastating for Americans making them worse off. In fact, it is the other way around. Increasing American incomes have allowed them to buy stuff from other countries. So, instead of incomes falling with the trade deficit, is the other way around.

US GDP per capita and US current account in percent of GDP.

Source: Fred database.

Current account deficits made Japan, South Korea and Sweden richer.

Sort of. Many countries as Japan, South Korea have borrowed from abroad to build capital stocks while running current account deficits. Also, Sweden did in the past run current account deficits to finance investments. Sweden borrowed money from abroad to build large parts of its railways during the 19th century.

Sweden. Investments and the current account balance relativt to GDP 1850-1914.

Source: Edvinsson, R. Historical National accounts for Sweden.

The returns from these investments, in terms of increased production and prosperity, allowed the borrowers to service and pay back their debts.

The conclusion is of course that trade deficits can be good both if you want to use your income for consumption today or to invest for future consumption tomorrow.

-