Should Sweden adopt the Euro?

Have our industry structure and business cycle become more similar to the Euro countries?

Spoiler: We held a referendum in 2003. The majority wanted to keep the SEK. The strongest argument against adopting the Euro was that with the Euro we would lose the ability to an independent monetary policy. That is important if our business cycle is not synchronised with the Euro area business cycle. Or at least with the business cycles of the largest countries.

That’s why there was a lot of talk about “asymmetric chocks”. Those were supposed to be large fluctuations in demand and supply that would affect us differently that the Euro area countries due to large differences in industry structure. To summarise: differences in industry structure create differences in business cycles which make it a bad idea to have the same currency and monetary policy as the Euro area.

Source: https://commons.wikimedia.org/w/index.php?curid=66700079

According to the theory of optimum currency areas, OCA, similarity of business cycles is one out of four criteria which should be met for countries to form a currency union. This has something to do with similarities of industry structures. Business cycles occur due to changes in demand and supply. As one example, large increases in energy prices will affect countries where energy intensive industries account for large shares of GDP, more than other countries. Increased trade will also affect industry structures if allocations of resources in countries are allowed to adapt to changes in comparative advantage. Some trade will incrase differences in industry structure, while other types of trade will even out differences. Typically, North-South trade, following the predictions of the Heckscher-Ohlin theorem increases industry strucure differences while intra-industry trade tends to even out differences.

A problem arises when one tries to measure this. Lacking data on factor endowments and technology, the measurement becomes dependent on how an “industry” is defined. Below, very broad aggregates are used. Only thirteen aggregates for Agriculture, Mining, Manufacturing, Energy, Water supply, Construction, Wholesale- and Retail Trade, Information & Communication, Financial Services, Real Estate, Professional Services, Public Administration, and Arts & Entertainment, are used.

Differences in industry structure are calculated as the square root of the sum of squared differences in industry shares in GDP between Sweden and the four countries. The difference between Swedish, S, and German, D, industry structures is then calculated as.

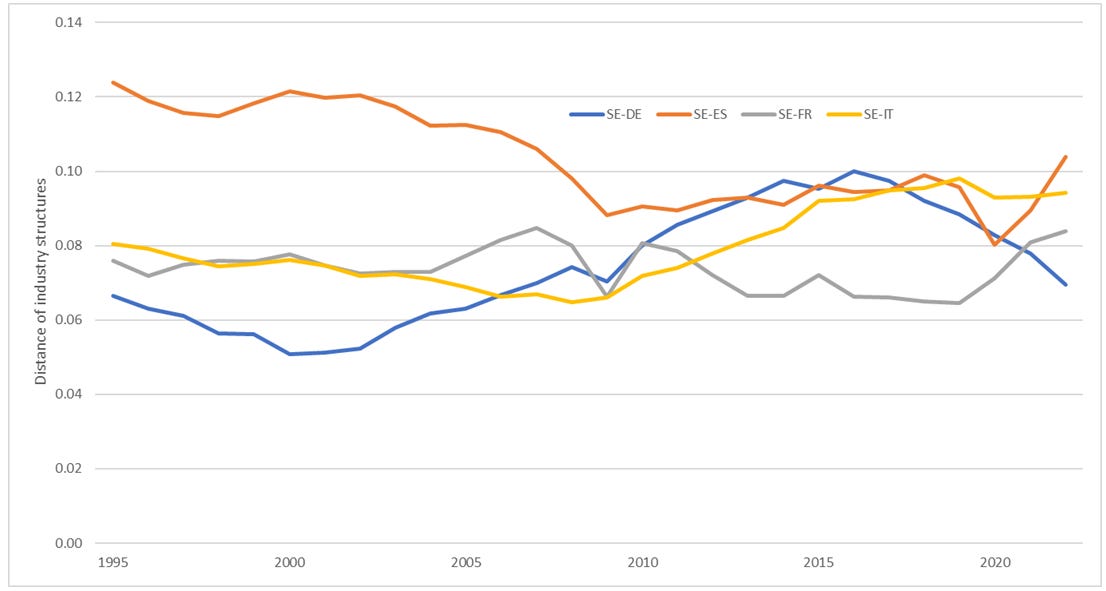

These calculations provide us with some interesting and varying results. It appears that the difference between Sweden and Spain has decreased, while it has increased between Sweden and Italy. The difference between Sweden and France has not changed, but the difference between Sweden and Germany has. It decresed in the first five years following our membership in the EU, then increased for 15 yeas after which it had decreased again. It has increased for the whole period.

Differences in industry structure 1995-2022 between Sweden and France, Germany, Italy, and Spain.

Source: Eurostat database.

Overall, no large differences now compared to 1995. Let’s look at the business cycles measured as GDP relative to the same quarter the previous year. The spike in the third quarter of 2013 is the result of a one-percent increase of Swedish GDP relative to a 0.03 percent increase of Euroa Area GDP and can be ignored. Measuring similarity in business cycles this way does not give rise to any spectacular results. The lack of changes in the relationship between changes in GDP is confirmed by calculating correlations for different periods of time between 1995:1 and 2023:2. Choosing different dates for beginning and ends of time periods do not result in any significant differences in correlations of GDP changes over time.

Relative percentage changes of the SEK to the EURO over four quarters 1996-2023.

Source: Eurostat database.

The graphs above neither strengthen nor weaken the argument for adopting the Euro as not much have changed since 1995 wrt to differences in industry structure and business cycles. Maybe someone measureing these differently will draw the opposite conclusion, I don’t know.

The above might suggest that Sweden should keep the SEK and retain its independent monetary policy. But the independence of our Riksbankd has been questioned. Changes in Euro policy rates and the US rates are more often than not followed by a change in our policy rate.

In any case, there are other reasons why Sweden should perhaps join the EMU and adopt the Euro. Some of those are more focused on politics and concern Sweden’s overall influence in the EU. I find this very speculative, so I will not waste my time on that.