Spoiler: BRICS is nothing else than an acronym. Intra-BRICS trade and FDI make up for small shares in total trade and FDI, there won’t be BRICS currency, their New Development Bank undertakes very few projects, and refuses to undertake projects in one of the member countries: muscovy.

Is BRICS something else than an acronym? From the beginning, it wasn’t. It was coined by a Goldman Sachs economist speculating about the growth of Brazil, China, India, and muscovy. Late South Africa was added.

Apart from China and India, the growth of the BRICS has been rather disappointing. But BRICS is not only mentioned in terms of expected growth, it is portrayed as an alternative to what is perceived as economic dominance by the “West”. To achieve this, there has been talk about integrating the five economies.

Not a lot of trade within BRICS

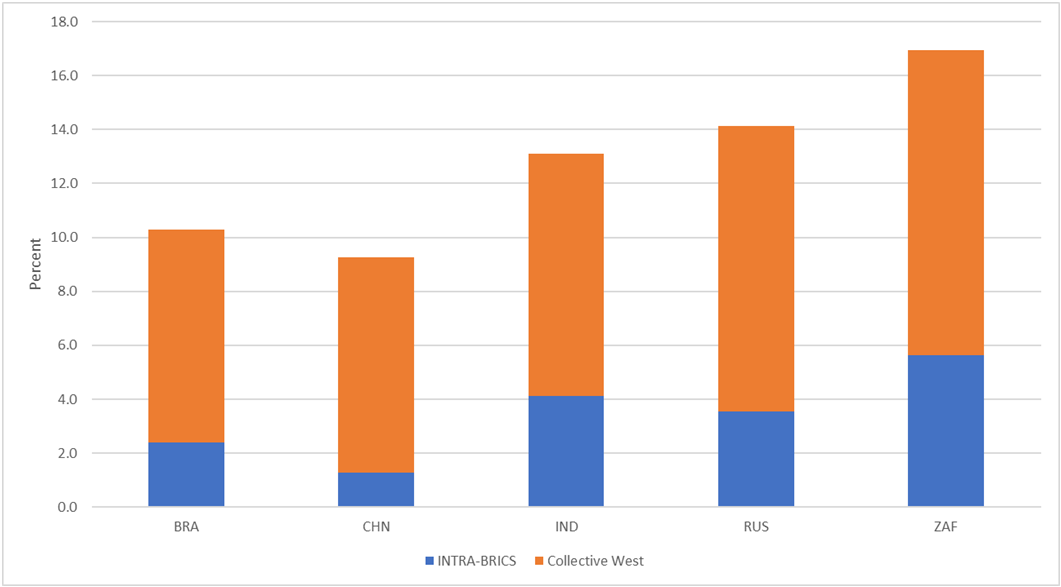

The thing is however, that the “Collective West”, as the little person in the kremlin and his horse-face of a foreign minister name the countries which oppose the kremlin’s genocidal war, matters more for BRICS countries than other BRICS countries. There are different ways to measure the interdependence of countries. One way is to look at how important other countries’ final demand (consumption+investments) is for your own GDP. The graph below shows that for each of the BRICS countries, the “Collective West” is much more important than the other BRICS countries.

Shares in GDPs due to final domestic demand in BRICS 2018.

Source: OECD, Trade in Value Added.

In fact, as I showed in my first note about BRICS, the EU, UK and US are much more important than the other BRICS countries.

And even more disappointing for those that think BRICS is more than an acronym, out of the BRICS countries, only China matters. Almost nothing of the GDPs in Brazil, India, muscovy and South Africa are generated due to each others’ demand.

The little person in the kremlin has ordered his horse-face of “foreign minister” to go around Africa and Latin America to find support and establish economic relationships. Why this should succedd when it hasn’t in the past is beyond me. The truth is, as I showed previously, that, for most countries, muscovy just doesn’t matter.

muscovy doesn’t matter a lot for the other BRICS countries either: muscovy final demand only accounts for 0.4% of Chinese GDP and 0.2% of Brazilian, Indian, and South African GDP.

Not a lot of FDI within BRICS

And it doesn’t seem as BRICS’ firms invest that much in each other as one would expect from all this noise about its importance. Most of FDI inflows in Brazil, Indian and South Africa are made by American and European firms. In fact, as UNCTAD's World Investment Report 2022 shows, most of the FDI flows and stocks in BRICS countries are done and held by investors from non-BRICS countries. And most of BRICS’s FDI outflows and stocks are directed to and held in non-BRICS countries.

And no one wants to invest in muscovy anymore:

The direct effects of the war on investment flows to and from the Russian Federation and Ukraine include the halting of existing investment projects and the cancellation of announced projects, an exodus of MNEs from the Russian Federation, widespread loss of asset values and sanctions virtually precluding outflows.

The value at risk is significant. MNEs from developed economies that support the sanctions account for more than two thirds of FDI stock in the Russian Federation (with a significant part of the rest accounted for by offshore financial centres (OFCs)). In contrast, to date, MNEs from China and India account for a negligible share of FDI stock in the Russian Federation (less than 1 per cent), although their share in ongoing projects is larger

China is mainly investing in those parts of muscovy that they regard as part of China and where they have begun to restore Chinese names on maps.

De-dollarisation and a BRICS currency won’t happen

What else is BRICS supposed to do? It has been a lot of talk about de-dollarisation. BRICS countries, especially muscovy, have been discussing to ditch the dollar when trading with each other. Which they almost don’t do as I showed above. And that is one reason why the de-dollarisation won’t happen in the foreseeable future. The thing is that if you need to buy stuff from other countries, you need their currencies. And BRICS countries trade more with the US and the EU than with each other which I showed in this note.

But dollars also used in trade with other countries than USA. Lots of trade between countries is denominated in dollars because it is efficient to do so. Invoicing and payment systems in firms all over the world are made in dollars. Financial flows are mostly denominated in dollars. Countries and financial institutions issue bonds and service debts in dollars. In fact, also the BRICS’ New Development Bank, see below, issues bonds in US dollars

So for BRICS, neither de-dollarisation nor de-eurosation will happen for a long time. Unless you get sanctioned like muscovy of course and won’t need your dollars and euros if the G7 proposal of banning exports to muscovy flies. Which will mean that 50% of muscovy’s foreign exchange reserves cannot be used.

Why not use the Chinese currency, Renminbi? China is actively trying to conduct their trade in renminbi. If the BRICS should manage to become a trade-bloc of importance, the renminbi would either be the offical BRICS currency, or dominate a new currency. The problem is that China uses capital controls that restrict the selling of renminbi for other currencies. So, the renminbi will not be an alternative unless the Chinese Communist Party (CCP) agrees to give up its control of the renminbi.

The CCP’s reluctance to abandon the capital controls also prevent the formation of a new currency which is dominated by the renminbi. I don’t think India would accept fluctuations affecting the Indian rupee and economy due to the CCP’s decision on restricting or relaxing capital flows to and from China.

And I can’t really see India becoming dependent on China given the tensions between the two countries over Kashmir. This is a long-standing conflict between the two countries which probably precludes close cooperation between the two countries. As a direct result of China’s attempt to seize part of the Ladakh region during the Covid lockdown, India has reinforced its border troops to deter China.

The Contingent Reserve Arrangement was set up as alternative to IMF if any BRICS country should run into Balance of Payments problems. As far as I know, it’s capabilities have not been tested.

The little person in the kremlin fucked up again.

Other BRICS initiatives have failed too. The New Development Bank was founded in 2014 but haven’t delivered much, neither in approved nor completed projects. And that is not surprising since the little person in the kremlin decided to sabotage the bank’s operations.

The New Development Bank (NDB) applies sound banking principles in all its operations, as stated in its Articles of Agreement.

In light of unfolding uncertainties and restrictions, NDB has put new transactions in Russia on hold.

NDB will continue to conduct business in full conformity with the highest compliance standards as an international institution.

What else remains? The planned optical fibre submarine communications cable is another of those projects that remain to be completed.

Conclusion. BRICS is an acronym. No more, no less