Brexit and UK integration in EU supply chains.

We will miss you guys.

On Tuesday the 15th of January, Theresa May’s negotiated Brexit deal may be voted down in the Parliament. Thus, there is a serious risk that there will be a hard Brexit. If one wants to have an idea of the consequences for the UK economy, one can consult The Bank of England’s web site, The Bank’s analyses indicate that a hard Brexit could lead to UK GDP being around 10% lower in 2023.

The scenario reflects the consequences of a hard Brexit with customs inspections, long delays at ports and disrupted supply chains for UK firms using intermediate products from the EU. The same applies to service providers. EU firms using UK intermediate products will of course suffer similar problems.

The interdependence between UK and EU can be analysed in many ways. In this and the next entry I look at export flows between the UK and EU. When exporting, countries and industries participate directly by using foreign intermediate goods in its exports and indirectly by supplying intermediate products for the use in production of other countries' exports. In order to show these flows importance for a country or industries, they are related to total exports for the country or industry.

Analyses of export flows like this are usually carried out in terms of global value chains (GVCs) with the aid of multi-country input-output tables such as WIOD. WIOD (www.wiod.org) makes it possible to calculate exports in terms of value added. A brief description of GVCs can be found in the previous entry here

The analyses below use WIOD data. This entry deals with how goods and services produced in the UK are used in EU countries’ exports while the next entry concerns how UK uses EU goods and services in its own exports.

For large countries, as the UK, indirect (value added) exports are higher than direct (foreign value added) exports. In fact, UK had one of the largest indirect value added exports of all EU Member States. In percent of total exports, indirect exports amounted to 29% and direct exports to 19% of total UK exports in 2014, c.f. Table 1.

Table 1. Foreign value added and UK indirect value added as shares in UK total exports 2014. (Percent)

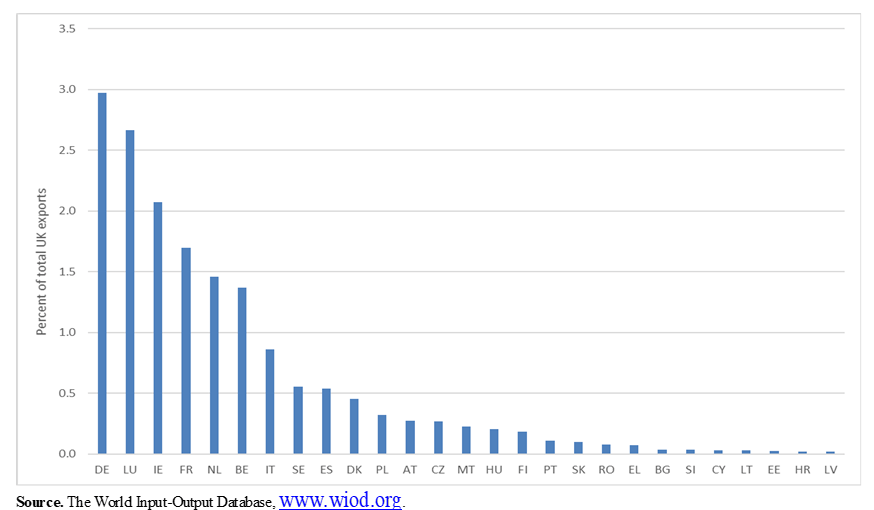

The most important EU destinations for UK indirect value added exports are Germany, Luxembourg, Ireland and France. These four destinations make up more than half of the UK indirect value added exports, c.f. Figure 1.

Figure 1. UK indirect value added exports for different destinations 2014. Percent in total UK exports.

Looking at industries gives rise to two main conclusions. The first is that EU is much more important as a destination than non-EU markets. The second conclusion is that a Brexit will be most felt in knowledge-intensive service industries such as Business Services although the EU markets are most important for Wharehousing and Transport Support services. c.f. Figure 2.[1]

Figure 2. Indirect value added shares in UK industry exports 2014. (Percent of total industry exports).

Conclusion

Whether one thinks Brexit is a good idea or not, one should be aware of that the decision to leave the EU will severely disrupt UK industries' global value chains. This will be mostly felt by people working in Service industries .

[1] Seven industries, Repair and installation of machinery and equipment, Electricity & Gas, Water Supply, Construction, Land transport, Postal and courier activities and Real Estate, have been excluded from Figure 3. The reason is that at disaggregate levels, for sectors that have zero or very small direct exports but positive indirect value added exports, the indirect value added shares can be infinitive, cf. Koopman et.al. (2010). The above mentioned industries are subject to this and have indirect value added shares between 180% and 730%.