Brexit and Sweden

The shit hit the fan today. It may still be a hard Brexit unless all negotiations are closedbefore the end of the year. In the case of a hard Brexit, consequences will be worse since firms inside or outside of Britain will have less time to adapt to the changed conditions. The current supply chains might be disrupted as the existing buyer-seller relationships may need to be replaced due to changes in costs to import and export from and to the UK. Swedish firms relying on British intermediate products may find that relative prices of these products have increased so much that new suppliers must be found. And vice-versa, Swedish firms supplying intermediate products may find that the new conditions may not make the British market profitable anymore.

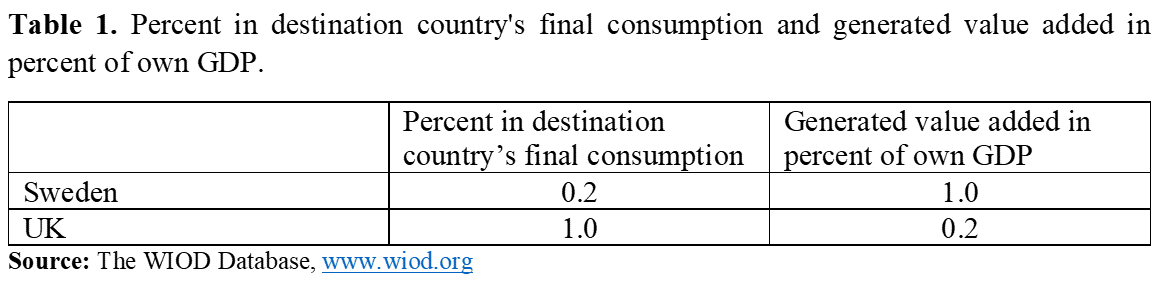

Below I have a look at the interdependence between Sweden and the UK. The extent of interrelations between the two countries and their industries gives a hunch of what Brexit will mean on the macro level as well as industry level.

As in previous entries about EU-UK supply chains here and here, the interdependence between Swedish and UK firms or industries can be analysed with the input-output tables. These tables, unfortunately only cover the independence in terms of supply chains up to 2014.[1] Another name for this international supply chains is of course global value chains. See here for a definition of global value chains. Trade data, which of course is included in the input-output tables, is available until 2018. According to Statistics Sweden, Swedish imports from and exports of goods to UK amounted to around five and six percent of total Swedish imports and exports between 2016 and 2018. Swedish-British trade in services was relatively larger: while Swedish imports from UK amounted to some 9 percent of all imports of services, Swedish exports of services to UK amounted to 11 percent in total Swedish trade with services. I am too lazy to extract the numbers but an educated guess from my side is that imports from and exports to Sweden constitutes relatively smaller shares for UK trade.

My guess can be checked against an analysis using WIOD. I will have a look at the British-Swedish trade interdependence by using two different concepts. These concepts are i) Trade in Value Added (TiVA) and ii) Value Added content in Trade (VAiT) following Stehrer (2013). TiVA accounts for the value added of a country which is directly and indirectly embodied in final consumption of another country. VAiT measures the domestic and foreign value added embodied in a country's gross exports.

Beginning with the first concept we see that my guess above seems to be correct. The second column shows that a larger share of GDP is generated in Sweden due to final consumption in the UK than vice versa. And consequently, Swedish exports to the UK constitutes a smaller share of UK final consumption than vice versa.

Turning to the other concept, VAiT, table 2 further confirms my guess. As a smaller country, Sweden is more reliant on imported intermediates than the UK which can be seen from the first two columns. And in line with that result, the Swedish value added share of UK gross exports is smaller than the UK value added share of Swedish exports.

Table 2. Domestic and foreign value added shares in percent of gross exports 2014.

Breaking it down by industries shows that only in Forestry and Wood Industries are Swedish value added shares of UK exports larger than UK shares in Swedish exports.

Figure 1. Swedish and UK value added shares in each other’s industries' gross exports 2014 (%).

The exercise above has only shown the interdependence on macro and industry level. Judging by the numbers above one might draw the conclusion that Brexit is not a big problem neither for UK nor Sweden as both the value added shares in gross exports and the shares in GDP seem so small. Comparing Swedish and UK shares in GDP that are generated by each other’s final consumption with how much is generated due to final consumption in other countries may question the validity of that conclusion.

Not surprisingly, final consumption in the large aggregate Rest of the World (RoW), generates the largest shares in both Swedish and UK GDP. Apart from Nordic countries, also USA, Germany, France and China are important as well as other Nordic countries are for Sweden.[2] The main observation is however, that shares are relatively small across the board, c.f. Figure 2.

Figure 2 Swedish and British generated value added in shares of own GDP due to foreign final consumption 2014.

The implication of that is that (a hard) Brexit will seriously disrupt trade flows between firms and in the end affect consumer welfare as prices will be higher and the number of varieties smaller. The tables and figures made for industrial relationships across countries on a highly aggregated level. They tell us nothing about the consequences for people working in businesses trading with the UK. Big firms may have in-house resources able to cope with the increasing burdens in shape of customs declarations, certificates of different kinds needed for complying with the new situation as UK will not any more be part of the Single Market. But this is often not the case for SMEs. The increased tariffs and costs due to administrative burdens might force UK firms out of the EU markets and vice versa.

That does not mean that large firms are indifferent. Investments in the UK are declining and some foreign firms are planning to leave. All these developments boil down to one consequence for ordinary Brits. They will be poorer.

[1] OECD have published global value chain indicators for 2015 http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm but I have not had time to explore that yet. I wonder if I ever will because I am getting fed up with this shit.

[2] A figure showing British and Swedish value added shares in all other countries’ gross exports yields essentially the same result.